Protección contra apropiación de cuentas: lo que necesita saber

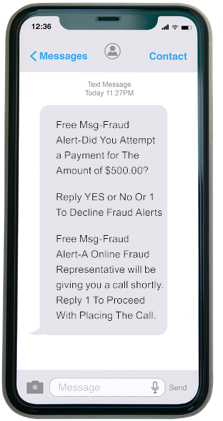

La apropiación de una cuenta comienza con un estafador/a que le envía un mensaje de texto a su teléfono móvil. Por lo general, suelen decir que son del departamento de estafa de IncredibleBank. Le pueden pedir que confirme un pago sospechoso que se envió desde su cuenta, esto puede ser falso y puede ser parte de la estafa.

Si es una estafa, el/la estafador/a puede hacerle una llamada telefónica y preguntarle información personal para "cancelar el pago". ATENCIÓN: IncredibleBank NUNCA le preguntará por su número de seguro social completo, la contraseña de su banca en línea ni por otra información personal.

Una vez que el/la estafador/a tiene acceso a sus credenciales de banca en línea, comenzará a realizar cambios en su cuenta, por ejemplo, actualizar su información personal de identificación, agregar un usuario autorizado o cambiar la contraseña. Estos cambios no solo permiten que ellos accedan a sus cuentas, sino que también lo bloquean a usted de su propia cuenta, por eso se llama "apropiación de cuenta".

La estafa de apropiación de cuenta generalmente comienza los viernes luego del horario hábil y continúa durante el fin de semana. También ocurre durante los feriados. ¿Por qué? Porque están esperando que usted se tome el fin de semana o el feriado, así no se dará cuenta de que algo anda mal hasta que sea demasiado tarde.

Cómo protegerse: Lista de verificación rápida de prevención

- Habilite la autenticación de dos pasos (2FA): añada una capa adicional de seguridad a su cuenta.

- Supervise la actividad de su cuenta con regularidad: compruebe si hay transacciones sospechosas o intentos de inicio de sesión.

- Tenga cuidado con los mensajes de texto, los correos electrónicos o las llamadas telefónicas: los estafadores suelen hacerse pasar por su banco para robar información.

- No comparta nunca contraseñas o códigos de verificación: no los proporcione por teléfono, mensaje de texto o correo electrónico.

- Utilice la protección del dispositivo y actualice el software: mantenga sus dispositivos seguros y el software actualizado.

- Configure alertas de cuenta: reciba notificaciones de actividad inusual para actuar rápidamente.

Pasos para detener la estafa de apropiación de cuenta antes de que suceda

1. Desconfíe de los mensajes de texto, correos electrónicos o llamadas telefónicas que dicen ser su banco

2. No comparta su información

3. No se apresure

4. Qué hacer si ya ha proporcionado su información

Si por error proporcionó información a estafadores, revise sus cuentas financieras para saber si hay actividad inusual, regístrelo e informe a su banco de inmediato (de hecho, ¡infórmelo a su banco incluso si aún no ha visto actividad sospechosa!). Su banco también puede recomendarle pasos adicionales para protegerse.

Si proporcionó su número de seguro social, le recomendamos que se comunique con la Administración del Seguro Social y con cada una de las tres agencias de crédito para congelar su crédito.

Conozca más sobre cómo protegerse del robo de identidad en nuestro blog de seguridad informática.

¿Cómo evitar una estafa de apropiación de cuenta?

No comparta información

Si alguien que se hace pasar por IncredibleBank se comunica con usted por teléfono, correo electrónico o mensaje de texto y quiere que comparta su información personal, considérelo una estafa.

No conteste

Si recibe un mensaje de texto o un correo electrónico, no le conteste al remitente. Ignore el mensaje y no llame a ningún número que aparezca en el mensaje de texto.

Cuelgue y llámenos

Si recibe una llamada telefónica que parece ser un intento de suplantación de identidad, finalice la llamada enseguida. Recuerde: los códigos de área locales pueden ser engañosos.

Preguntas frecuentes sobre la estafa de apropiación de cuenta

¿Qué es una estafa de apropiación de cuenta?

La estafa de apropiación de cuenta ocurre cuando un estafador/a obtiene acceso a su cuenta bancaria al robar sus credenciales de inicio de sesión o información personal. Luego pueden cambiar sus contraseñas, bloquearlo e iniciar transacciones no autorizadas, a menudo dirigidas a sus cuentas personales de cheques o ahorros.

¿Cuáles son las señales de una estafa de apropiación de cuenta?

Las señales de advertencia incluyen mensajes de texto o llamadas inesperadas que dicen ser de su banco, cambios en su información de contacto y actividad no autorizada en sus cuentas. Para las empresas, la actividad inusual de nómina o pago también puede ser una señal de alerta. Herramientas como Positive Pay pueden ayudar a detectar las estafas a tiempo.

¿Cómo sucede normalmente la estafa de apropiación de cuentas?

A menudo comienza con un mensaje de texto de phishing que se hace pasar por su banco. Si responde, el estafador puede llamarlo para recopilar más información personal y obtener acceso a su cuenta. Para las empresas, las credenciales comprometidas en las plataformas de pago o nómina también pueden ser un objetivo, así que asegúrese de utilizar herramientas seguras como IB Payroll.

¿Qué debo hacer si sospecho que mi cuenta se ha visto comprometida?

Comuníquese de inmediato con IncredibleBank al 1-888-842-0221. Revise sus cuentas para ver si hay actividad inusual, documente lo que ve y siga los pasos que le indique su banco. Si usted es una empresa, considere la posibilidad de inscribirse en herramientas de administración de efectivo para mejorar la seguridad de su cuenta en el futuro.

¿Cómo puedo protegerme en el futuro?

Controle sus cuentas personales y empresariales con regularidad. Configure alertas, use contraseñas seguras y evite hacer clic en enlaces de mensajes no solicitados. Para los propietarios de empresas, herramientas como Positive Pay y las soluciones seguras de nómina pueden reducir el riesgo y mejorar la detección de estafa.